What is Shipping insurance | Everything you need to know

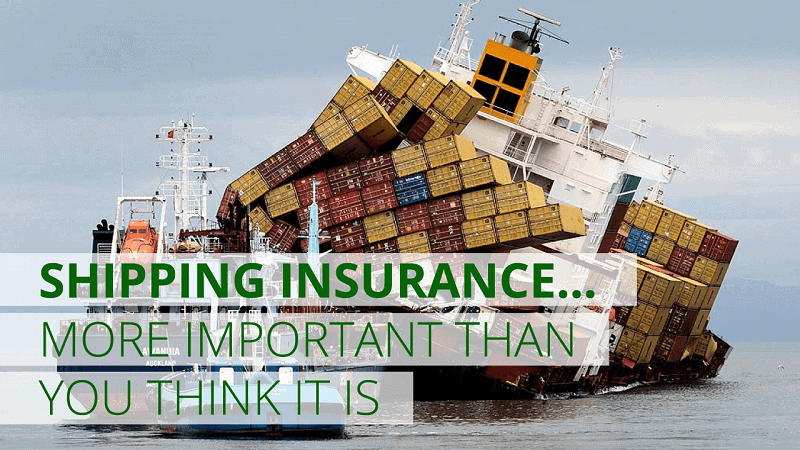

Shipping insurance is an aspect of shipping that people often overlook.

It’s crucial for both businesses and consumers because it provides protection.

Basically, if there’s any loss or damage that happens while goods are being transported, the insurance will cover it.

- What is Shipping Insurance

- Benefits of Having Shipping Insurance

- Different Types of Shipping Insurance

- What does shipping insurance cover?

- How does shipping insurance work?

- Who pays for shipping insurance?

- How much does shipping insurance cost?

- How to File a Claim with Your Insurance Provider

- Tips on Choosing the Right Type of Shipping Insurance

- FAQs About Shipping Insurance

- Winsky Freight Shipping Insurance Offer

What is Shipping Insurance?

Imagine being able to walk through a storm without getting wet or struck by lightning. That’s pretty much how shipping insurance works.

If your package gets lost, stolen, damaged, or goes missing during transit, this policy keeps you covered until it reaches its destination.

Most major carriers offer this type of coverage as a service to protect your packages if your package didn’t arrive when it was supposed to. Go ahead and file an insurance claim based on the things inside.

Once they confirm that your package was indeed lost — which isn’t common — you’ll be reimbursed.

While most shipping insurance comes from carriers themselves, there’s also third-party insurance available too.

People usually use third-party options when they’re dealing with valuable items or shipments that go beyond carrier limits.

Top-notch forwarders such as Winsky Freight can give you some sweet rates when it comes to shipping insurance. It’s like a net in the wild world of logistics and freight that gives you peace of mind and financial protection.

Advantages of Shipping Insurance

Shipping insurance is a strategic asset for your business, not just a protective measure. Below, we’ll look into the reasons why having shipping insurance is a great idea.

Financial Security

First and foremost, it offers financial protection. Don’t worry about any kind of financial loss when a package gets damaged or lost in transit.

With this insurance policy, you don’t have to drop extra money to replace any damaged or lost goods. It could be the difference maker for small businesses.

Peace of Mind

Next up is peace of mind. When you’re sending a package, you’re really sending something more than that — your time and hard work as well.

Those are investments on their own without the safety factor of goods. By knowing that your shipment is insured, you can focus on other aspects of your business and not have to worry about the protection level of your items.

Quick Claims Process

Aftermaths are always so stressful when things go wrong. But with shipping insurance providers like Winsky Freight, there’s no need to worry about it being complicated when making claims.

All you need to do is tell us what happened, send Commercial Invoice & Packing list, and we can take care of everything else from there in a simple and straightforward manner. Most good shipping insurance companies work the same way.

Improves Customer Service

Each company should prioritize customer satisfaction since, without it, customers won’t return or suggest them.

You never know when anything might go wrong with one of their orders. But with this coverage, you can promptly submit a claim and replace the item. A rapid reaction may increase client satisfaction and loyalty, preserving your reputation.

Global Coverage

Shipping insurance provides coverage regardless of where you’re shipping to. Domestic or international, it doesn’t matter. With the right insurance policy, you can confidently expand your business to different markets across the world.

So, do you need a shipping insurance? Here is a video of a real-life experience of a shipper:

Different Types of Shipping Insurance

Knowing the various types of shipping insurance will help you make a smart choice. Now, we’ll go over three common ones that businesses often use.

Carrier Liability Insurance

First and foremost is Carrier Liability Insurance. The carriers themselves provide this type of coverage, like USPS, UPS, or FedEx. But there’s one thing about it that’s important to keep in mind here — it only offers limited protection.

It usually only covers direct physical loss or damage to the goods being shipped. Make sure you read everything carefully before deciding on this option.

Freight Insurance

Then, we have Freight Insurance. If you’re shipping bulky and large items, then this coverage is for you.

Compared to carrier liability insurance, Freight Insurance provides a much higher level of coverage, which makes it suitable for businesses dealing with high-value goods. If you want to ensure full protection on shipments, then look no further than this option.

Parcel Insurance

Parcel Insurance is ideal for small and medium-sized businesses that ship smaller items out regularly. It covers the full amount of value that the goods hold, making it a very popular choice among e-commerce businesses that deliver consumer products.

Third-Party Insurance

Finally, we have Third Party Insurance. Rather than the carrier offering coverage, an independent company does.

This option is a lot more comprehensive and proves useful when shipping high-value items or if the carrier’s coverage limit isn’t enough. You should opt for this choice if you’d like added peace of mind.

What does shipping insurance cover?

Loss or Damage

Shipping insurance mainly covers the loss and damage of goods. The reason could be due to accidents, theft, natural disasters, or poor handling during transit. Whether it’s something as fragile as an antique or something big like a piece of machinery, your goods are covered.

Theft or Pilferage

Another area where shipping insurance steps in is if anything gets stolen during transportation or storage. It will give you peace of mind knowing that no matter what, your goods are financially protected even when out of sight.

Damage in Transit

Did you know that shipping insurance covers damage that happens while being transported? It does! Anything that happens during loading, unloading, or while being moved is covered, including accidents and rough handling.

Fire and Explosion

Shipping insurance also protects against any damages caused by fire and explosions during transit. Your goods are guarded against these unpredictable incidents so you can go about your day without worrying.

Cost of Salvage

It also covers the cost of damages, which includes any reasonable costs incurred to salvage the goods or to minimize potential losses during transit.

Partial Loss

Shipping insurance can also apply to partial losses. So if there’s only a portion of the goods that are affected, you’ll still be covered.

How does shipping insurance work?

Shipping insurance is a simple process. Let’s break it down.

Step 1: Insurance Selection

First, decide on what type of insurance you need. Take some time to research the options and understand what you require. After that, choose the best fit for your business.

Step 2: Get a Quote

After picking an option, it’s time to get a quote. You’ll be asked about your shipment details, like what it is, how much it costs, and where it’s going.

Step 3: Purchase Policy

With your quote in hand, begin purchasing the policy. All this requires is paying the premium, and you’re ready to go. Your goods are now insured.

Step 4: Shipping and Coverage

Ship your goods! Coverage comes into play as soon as your shipment hits a road or air pathway.

Step 5: Make a Claim if Necessary

Unfortunately, losses occur sometimes during transportation. If something goes wrong, file a claim with all of the necessary details and documentation to your insurance company.

Step 6: Assessment and Payment

The company of your choice will assess your claim. If approved, they will pay for any loss or damage up until their coverage limit.

Who pays for shipping insurance?

Shipping insurance is something that’s usually covered by the buyer. It’s not a direct charge, though. Instead, the cost of it is included in the overall shipping fee.

However, it’s possible for sellers or shippers to pay for it. If they do so, it’s added as an extra charge on top of the shipping fee.

Depending on what incoterms the sales contract states, who pays for shipping insurance can change.

For example, if the term is “CIF” (cost, insurance, and freight), then the seller is responsible for it. “FOB” (free on board) works differently, though. In this case, once goods reach a shipping vessel, then the buyer has to take care of insurance.

So, while generally speaking, buyers pay for shipping insurance, there are some situations where sellers have to pay.

How much does shipping insurance cost?

The cost of this kind of insurance depends on how much you’re actually shipping.

On average, rates are around 0.3% to 0.5% of what you declared your cargo value as.

So if goods are valuable, then expect to pay more money for coverage.

But remember that other factors also play a role in determining cost. Like where you’re shipping to and from and what specific terms are listed in your policy. Investing in more coverage will protect you more but add to the overall cost, too.

How to File an Insurance Claim

If you end up needing to file an insurance claim, it’s crucial that you know the process and what documents you need to submit. Here’s a step-by-step guide on how to navigate through this task effectively:

Step 1: Talk with Your Provider

The first thing you want to do is get in touch with your provider. Inform them of the issue as soon as possible. Most providers have a specific timeframe in which they expect claims to be reported, so don’t wait.

Step 2: Get All the Documents

Next, gather up all the necessary documents. These will include:

- Contract: This is the agreement between both parties (you and the insurer).

- Shipping Order: Also known as a consignment note, it acts as proof of an agreement.

- Invoice: A document that provides details on what was shipped and its value.

- Packing List: Describes every item in your delivery down to its packaging.

- Weight Verification: Shows the weight of your shipment.

- Certificate of Loss or Damage and/or Short Delivery: Confirms if there was any loss, damage, or short delivery of your shipment.

- Survey Report: If a survey was conducted, send this in, too.

- Claim Statement: A detailed account of your claim, including all amounts being claimed.

You can learn about most of these documents from our blog of custom clearance documents.

Step 3: Hand It Over

Now it’s time to give them everything that you’ve gathered. Usually, they’ll hand you a form made specifically for claims. All you need to do is attach all the required documents and send them back their way.

Step 4: Keep Track

Once you’ve turned everything in, make sure that you follow up with them. Their claims department should reach out with either the result or if they need additional information.

Just a little reminder, though. Every insurance provider has small differences when it comes to their own personal claims process. So it’s always a good idea to ask for specific instructions.

Tips on Choosing the Right Insurance

- When should you choose your shipping value and fragility?

- Do different companies have different policies?

- Is there a specific coverage type you need?

- Understand what’s not included in the policy.

- Can your carrier insurance options be checked?

- Figure out how their claims process works.

- Price always matters, especially when budgeting.

- You don’t want something with too long of a policy duration.

- What do customers say about their reviews and recommendations?

- If you’re uncertain, consulting with an expert is never a bad idea.

- Read their terms carefully before committing to anything.

- Familiarize yourself with international shipping customs regulations.

- Check if the coverage can change to meet shipping needs.

Shipping Insurance Frequently Asked Questions

Who needs shipping insurance?

Any business that ships goods, especially high-value or fragile ones, can benefit from shipping insurance. This includes retailers, wholesalers, manufacturers, and freight forwarders.

Is shipping insurance worth it?

Think of shipping insurance as a safety net for unexpected situations. It’s definitely worth the peace of mind and financial security it brings. Even if the costs vary depending on your situation.

Can I rely on carrier insurance offered by shipping companies like FedEx or UPS?

Carrier insurance doesn’t offer comprehensive coverage. It’s best to understand what they cover and get additional insurance if needed.

Winsky Freight Shipping Insurance Offer

We’re proud to offer comprehensive shipping insurance here at Winsky Freight.

The cost is 0.3% of the value of the goods, with a minimum of $25 per shipment. You won’t have to worry about risks such as physical loss or damage, theft, and natural disasters.

Our claims process is super easy as well; you’ll be able to get financial protection in no time.

Don’t leave your shipments out in the open to unforeseen events; make an investment in them with Winsky Freight today!

For more details on international shipping from China or shipping insurance suggestions, you can contact us anytime.

Leave A Comment