Import Tax from China to the US 2024

Every importer knows the importance of making budgets before shipping. A very important part of your total shipping costs is the import tax. The import tax calculation has become even more complex in recent years due to the trade war between the US and China. To avoid unpleasant surprises when shipping from China to the US, you must understand the HS codes, the fees involved, and how to calculate import duties accurately. This article will cover all this information about import taxes from China to the USA.

1. What is Import Tax?

Import tax is a fee that you pay when you bring in goods from one country into another. In the case of the USA, it’s a charge on products you import from other countries, like China. It is usually collected at the point of import by the customs authorities of that country. Countries charge import taxes for three main reasons:

- To protect local manufacturers by making imported goods more expensive for consumers.

- To raise revenue for the government.

- To control the market or respond to trade disputes.

Understanding import tax is important because it affects overall costs and determines your business’s profit margin. You need to factor in these charges when planning your budget from China to the USA.

Unlike many countries that use the CIF value to calculate customs value, the US uses the FOB value. The CBP believes customs value should be determined based on the actual price “payable” or “paid” for the goods before they are shipped to the USA. The FOB value includes the cost of the goods and any additional costs up to the point of exportation but does not include shipping and insurance costs.

Your tax is usually calculated as a percentage of this value, along with other duties and tariffs which we’ll explain as we go further in this article.

2. Types of Import Taxes in the USA

The US Customs and Border Protection (CBP) is responsible for listing the fees you pay when shipping from China. Based on their value, your goods will be classified as either a formal or informal entry.

- Informal entry is for imported goods worth less than $2,500. These are mostly goods imported for personal or small-scale business uses.

- Formal entry is for imported goods worth more than $2,500. They are usually for goods imported for business and commercial purposes.

Here are the major duties you should expect when shipping from China to the USA:

1. Customs Duties

CBP enforces an import duty/customs duty on any goods that cross the border into the USA. It is the biggest part of your import tax, but goods valued below $800 are not subject to this duty.

As you would expect, different goods have different duty rates. How much you end up paying depends on the type of goods and their value. The duty rate is determined by the Harmonized Tariff Schedule (HTS) code for your product and the country of origin.

For example, if you’re importing LED televisions, you would find the HTS code and apply the corresponding duty rate. Suppose the rate is 3% for a shipment worth $50,000; you would pay $1,500 in import duty.

Note that the customs duty is compulsory. The general import tax you pay is the customs duty plus other extra tariffs discussed below.

2. Excise Taxes

Excise taxes only apply to specific goods imported into the U.S. Goods like alcohol, tobacco, and gasoline. You only have to worry about it if your goods fall under these categories.

3. Anti-Dumping Duties and Countervailing Duties

Anti-dumping duties are applied on Chinese goods that are lowly priced compared to their locally made counterparts in the USA. It is done to give local markets an advantage and protect U.S. manufacturers. Aluminum products, ceramics, metals, etc., fall under this category.

Countervailing duties are also applied for similar reasons. They are used to offset subsidies provided by foreign governments to their exporters. If the Chinese government subsidizes a product, making it cheaper for Chinese exporters, the U.S. imposes countervailing duties on that product to level the playing field.

4. User Fees

- Harbor Maintenance Fee (HMF)

This is a small fee (0.125% of the shipment’s value) that you pay when goods enter through U.S. ports. It’s used for port maintenance and improvements and only applies to sea-shipped goods.

- Merchandise Processing Fee (MPF)

The MPF is used to fund CBP operations. However, there’s a little difference to note for the MPF: it differs for goods based on formal or informal entries.

For informal entries (good value < $2500), MPF is set at $2.22, $6.66, or $9.99 per shipment

For formal entries, MPF is charged at a fixed ad valorem rate of 0.3464% of the merchandise value. The minimum fee you can be charged is $31.67 and the maximum is $614.35. The table below explains MPF better.

| Entry Type | Value of Goods | MPF Rate | Categories (Examples) | Minimum Fee | Maximum Fee |

|---|---|---|---|---|---|

| Informal Entries | Less than $2,500 | $2.22 | Automated, not prepared by CBP personnel | N/A | N/A |

| $6.66 | Manual, not prepared by CBP personnel | ||||

| $9.99 | Automated or manual, prepared by CBP personnel | ||||

| Formal Entries | $2,500 or more | 0.3464% of merchandise value | General commercial imports | $31.67 | $614.35 |

5. Section 301 Tariffs

Section 301 tariffs are extra duties the United States imposes on certain products imported from other countries to address unfair trade practices. Since 2018, there has been an ongoing trade war between the USA and China, which has caused the U.S. to impose multiple rounds of tariffs on thousands of Chinese goods. These tariffs are separate from the regular customs duties you pay and can range from 7.5% to 25%, depending on your product category.

Does the Section 301 tariff affect your goods? If unsure, ask your customs broker or check CPB’s official website before shipping.

3. Understanding the HS and HTS codes

The Harmonized System (HS) code is an international standardized numerical method of classifying traded products. It is managed by the World Customs Organization (WCO) and used by over 200 countries.

Why is the HS Code Important?

The HS code simplifies the process of identifying products in international trade. Imagine that customs officials in every country must check each imported product individually during clearance to determine their duty rates. That would be very time-consuming. To make it easier, countries developed the HS code and assigned it to every product. Once customs see these internationally accepted codes, they immediately know the type of product you’re shipping.

Structure of the HS Code

An HS code consists of 6 digits, divided into three parts:

- Chapter: The first two digits indicate the chapter, which broadly describes the category of goods (e.g., Chapter 85 covers “Electrical machinery and equipment”).

- Heading: The next two digits specify the heading within that chapter. It gives more detail about the goods (e.g., 8504 indicates “Electrical transformers”).

- Subheading: The final two digits provide even more detail to classify the goods precisely (e.g., 8504.40 indicates “Static converters”).

Now, you might have heard of both HS codes and Harmonized Tariff Schedule (HTS) codes and wondered what the difference is. Countries are allowed to modify the HS codes by adding extra digits unique to the country. “The HS code is used globally, while the HTS code is unique to the United States.”

The HTS code is administered by the U.S. International Trade Commission and extends the HS code to 10 digits. The first six digits are the product’s HS code, but the extra digits are unique to the US.

How to Find Your HTS Code

HS codes determine the duties and taxes applicable to imported goods. Incorrect HS codes can result in paying more than necessary, customs delays, or fines. If you have a customs broker, finding the HTS code is easy because you can simply ask them. If you’d rather do it yourself, try one of the following methods.

- Consult the HTSUS: Detailed HTS codes and duty rates are available on the USITC website. You can enter the name of your product through the search bar to find the applicable codes and duty rates. If you already know your product’s first 4 or 6 digits, you can use this information to narrow the search and find the specific HTS code.

- Use Online Tools: Online databases like Freightos or Flexports offer search features to help you find HS codes based on your product descriptions. You can use them to match your product with the correct codes easily.

- Ask Winsky: We’re available to provide you with detailed HTS codes and duty rates for shipping to the USA. Contact us whenever you have an inquiry.

4. How is Import Tax from China to the US Calculated?

Your total import tax must account for the customs duty and other additional tariffs on your products. We’ll show you step by step so you don’t miss any important details.

Step 1: Identify the HS/HTS Code

Every HS code has a duty rate assigned to it. You must first classify your goods accurately by looking up your HTS code. We’ve explained how to do this in the previous section.

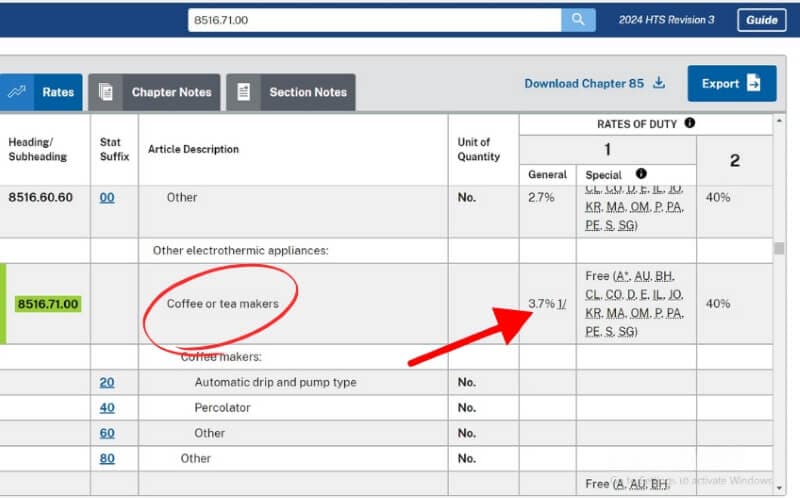

For example, if you are importing coffee makers, you first need to identify the chapter related to electrical equipment (Chapter 85). Then, locate the heading for electrothermic appliances (Heading 8516). Finally, find the subheading for coffee makers (subheading 8516.71.00).

Step 2: Find the Duty Rate

The duty rate associated with your HTS code can also be found on the USITC website. Type the HTS code in the search bar to find the rate, or scroll through your product category to find it.

Check for Additional Tariffs: Look for additional tariffs or duties that might apply, such as anti-dumping duties or Section 301 tariffs. If your goods are part of the goods taxed extra during the trade war, you’ll see an additional duty rate listed under the HS code. This rate is different from the general rate you need to pay.

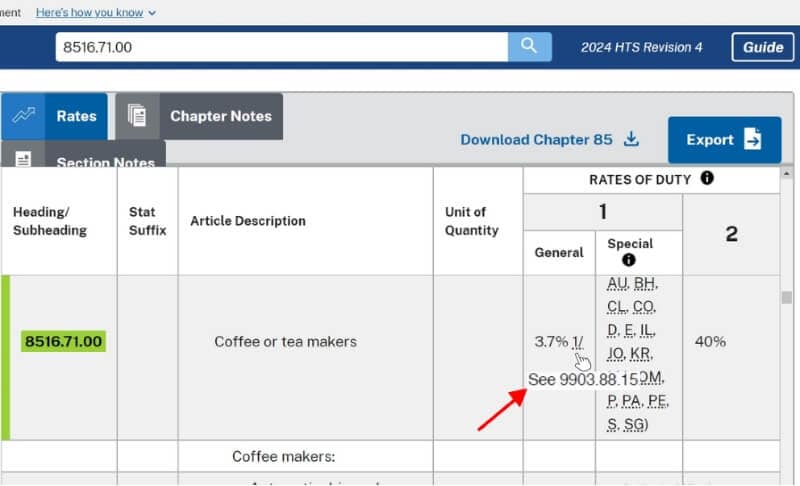

Let’s continue with our coffee maker example. Once you’ve identified that the correct HS code for a coffee maker in the U.S. is 8516.71.00, you’ll find two columns in front of it labelled “General,” which applies to Chinese goods. You can see that the General duty rate is 3.7%.

Ignore the Tariff 2 box. This tariff applies only to countries without a trade agreement with the USA, such as Cuba and North Korea.

Now, a little note under it asks you to “see 9903.88.15.”

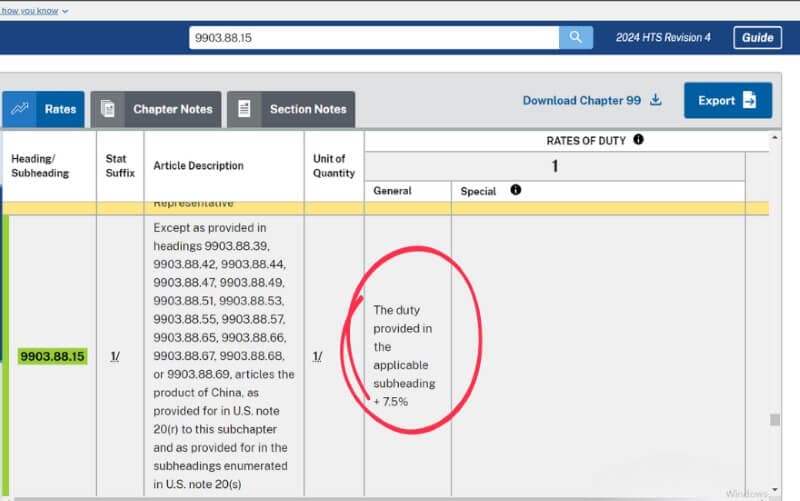

When you check this sub-heading, you’ll see a note stating, “The duty provided in the applicable subheading + 7.5%.” This means that the Section 301 tariff on this product is 7.5%. Therefore, your new duty rate is 3.7% plus 7.5%, which equals 11.2%.

Misreading the HS codes can be costly. Remember that the duty rate can always be updated. So, don’t rely on previous information when shipping. Always confirm again from your customs broker or freight forwarder.

Step 3: Calculate the Customs Value

The customs value is the cost of the goods up to the point of entry into the U.S. Remember that we mentioned already that US customs uses the FOB value of your goods. It should be stated on the commercial invoice obtained from your supplier. Please, ensure you have the right value on the commercial invoice, to avoid paying unnecessary costs.

“Your duty rate is calculated as a percentage of the customs value.” Some importers intentionally reduce this value to pay lesser duties. Be careful not to do this, as Customs closely monitors goods priced far below their market value. If you are caught undervaluing your goods, you may face heavy fines or your goods may be seized.

Step 4: Calculate Additional Fees

Merchandise Processing Fee (MPF): Calculate the MPF based on the type of entry (formal or informal). For formal entries, the fee is 0.3464% of the customs value, with a minimum charge of $31.67 and a maximum of $614.35.

Harbor Maintenance Fee (HMF): If you import through sea freight, you need to calculate 0.125% of the value of the goods.

Step 5: Calculate Total Import Tax

Now that you know the value and necessary tariffs, you can apply the duty rate. First, multiply the customs value by the duty rate to determine the amount of customs duty.

Customs Duty = customs value x customs duty rate

For example, if the customs value of our coffee maker is $10,000 and the duty rate is 11.2%, the duty will be $1120.

MPF Fee = cargo value x 0.3464%

$10,000 x 0.3464% = $34.64

HMF Fee = cargo value x 0.125%

$10,000 x 0.125% = $12.5

Sum Up All Charges: Add the customs duty, MPF, HMF together.

Total import tax: $1120 + $34.64 + $12.5 = $1167.14

Your estimated import tax is $1167.14.

Remember, the CBP has the final say on your exact duty rate. Your tax estimation might be wrong, depending on how well you read the HS codes.

5. Can I Get Import Tax Exemptions?

When shipping to the USA, there are some situations where you might be exempt from paying import taxes. If any of the following applies to you, then you’re eligible for an exemption:

Duty-Free Goods: Not every product is taxed by US customs. If your business involves duty-free products, you can benefit from this. Books, paintings, and artworks often fall into this category.

Products Intended for Personal Use: Remember that goods below $800 are free from customs duty. It is called the de minimis value. If your product is not for resale and falls under this value threshold, it might qualify for a duty exemption.

6. How to Reduce Import Duties from China?

Reducing import duties from China can lower overall shipping costs and improve profit margins. Here are some strategies we encourage you to consider:

- Use Free Trade Agreements (FTAs): The US does not have an FTA with China, but it does with some other countries that reduce or eliminate import duties. To bring down import tax costs, you can consider shipping your goods through countries that have favorable trade agreements with the U.S. and China.

- Classify Goods Correctly: Make sure your goods are correctly classified under the right HTS codes to avoid paying unnecessarily higher duties. Always ask your customs broker to help you find the most favorable classification.

- Claim Duty Drawback: If you import goods that are later exported, you may be eligible for a refund of the duties paid while importing into the US. It is known as a duty drawback, but the processing is complex. To take advantage of this, you must be well-versed in customs proceedings or ask your customs broker if you qualify.

- Negotiate with Suppliers: The truth remains that the lower your cargo value, the lower your import taxes. Try to negotiate with your supplier to get the best price possible. Please don’t significantly underprice your goods, as that’s suspicious to customs.

- Use De Minimis Value: Take advantage of the de minimis value threshold by dividing larger shipments into smaller ones to stay below $800 per shipment, which can help avoid duties.

- Proper documentation: Wrong or incomplete documents make you liable to delays and fines. You really don’t want that. Always check with your freight forwarder to ensure all required documents are intact.

- Value-Added Services: Some importers perform value-added services, like final assembly or packaging, in a lower-duty country before importing into the U.S. This can change the country of origin and help you qualify for reduced duties.

- Regularly Review Tariff Codes and Duty Rates: Duty rates and tariff codes can change. Stay updated and keep an eye on tariff exclusion lists released by the US, especially if your goods are subject to Section 301 tariffs.

Finally, and we can’t stress this enough, always use trade experts when shipping to the US, be it CBP-licensed customs brokers, freight forwarders, or other trade consultants. They’re your best bet for saving money on import duties.

7. How to Pay Import Tax?

After fulfilling every necessary condition, it’s time to pay your import tax. Your goods will only be released after import duty payments are made. Remember that the courier service will handle your taxes if you use express shipping. Better still, you can choose a DDP (Delivered Duty Paid) incoterm with your supplier or freight forwarder. This way, the headache of customs is not on you, and you simply receive the goods at your doorstep.

If you’re shipping by regular sea or air freight and are keen on avoiding import tax stress, just use a local customs broker for payment. They will submit your entry form (CBP Form 7501) and other important documents and then pay on your behalf. Other effective methods of paying import taxes include:

- Use Winsky. With over 15 years of clearing USA customs, we’re the easiest way to settle your import duties when shipping into the USA. We will manage the clearance process on your behalf and send you an invoice afterwards. Our team of customs brokers is on standby to make your import clearance process seamless.

- Automated Clearinghouse (ACH) System: An electronic payment method that authorizes CBP to electronically withdraw funds directly from your designated bank account.

- Credit Card Payment: Paying by credit card is convenient but not always available at every port.

- Check or Money Order: You can pay by mailing a check or money order to CBP. The payment must be issued by a U.S. bank and contain relevant details about your import.

- Cash Payment: You can pay import taxes in cash (U.S. dollars) at certain CBP outlets. It’s a less common option and only available in certain locations.

Customs Bonds

We should not end without explaining the concept of customs bonds. The CPB requires a customs bond when you import commercial goods worth over $2500 or regulated goods like drugs, food, or firearms. It might be a single-entry bond used for one-time shipments or a continuous bond that covers all shipments for a period of one year.

A customs bond can be obtained through licensed customs brokers or surety companies. It acts as a financial guarantee that the importer will comply with all customs regulations and pay the necessary duties, taxes, and fees. CPB gets payment from the surety company, and you pay the surety company later.

Conclusion

Shipping costs add up fast, and import tax is one of the biggest expenses you must prepare for. We hope this article has provided insights into the import tax calculation process in the USA. The least stressful method to clear customs is to use a reputable freight forwarder like Winsky. Our team of freight forwarders and customs brokers have extensive experience clearing customs from China to the USA. Our services are affordable, fast, and stress-free. Contact us today for a smooth clearance process in the USA.

Leave A Comment