The functions of air shipping documents for air transportation

Shipping goods by air freight requires you to fill out and provide several important freight shipping documents. Depending on where the goods are being sent and what kind of goods you’re importing, you may need one or all of the different documents discussed below.

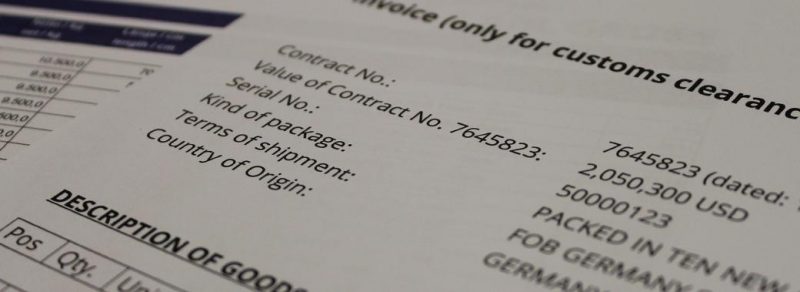

1. Import documents used for Customs Clearance

The most common required documents are the Commercial Invoice and the packing list Packing List.

Commercial Invoice – This is the most important document that certifies the price term, includes a detailed line-by-line description of every item in the shipment. It also lists the value of each item as well as the total value of the shipment. Some countries may require the use of their own specialized invoices.

The commercial invoice also includes basic information about the transaction, such as the name and address of the shipper and seller and the delivery and payment terms. The buyer can use the commercial invoice to prove ownership, and some governments use this document to assess customs duties.

Packing List – It is mandatory to put the shipping marks on all the cargo covering each and every individual piece or parcel. The details of the number of parcels in the consignment, their dimension, the shipping marks, the gross and net weights of each of the parcels along with the number of units contained in each parcel is cataloged in the form of the packing list.

Here are some examples of what an export packing list includes:

- Full name and address of the shipper

- Full name and address of the consignee

- Detailed specification of the goods

- Quantity of cargo

- Weight of the load

- Place of origin of goods

Packing List is used to identifying the parcels as belonging to the particular consignment under the said Invoice.

Certificate of Origin – Certain bilateral agreements and multilateral agreements would enjoy favorable tariffs for import duties. In such cases when the consignments are exported from such member countries, the designated Export Agency issues Certificate of Origin to the importer for submission to Customs. Based on this certificate the Customs Department of the Importing Country classifies the cargo under a specific schedule.

Certificate of Origin also helps to avoid third-party countries from routing imports through member countries and effecting third party exports to avoid duty, quantity or license restrictions.

Airway Bill – Airway bill is a negotiable transport document issued by the Shipping carrier or a Freight Forwarder who consolidates the airfreight cargo, certifying carriage of the said cargo under the specific invoice on behalf of the exporter or importer depending upon the terms of sale. This is one of the documents required for negotiations of payment from importer to the exporter.

Additional Documentation

Your shipment may require additional documentation depending on the type of goods being shipped and the destination country.

Here are other documents you may need:

- Dock receipt

- Warehouse receipt

- Insurance certificate

- Export license

- Certificate of Handling (Fumigation Certificate)

- Dangerous Goods Declaration

- NAFTA Certificate of Origin (for shipment between Canada, the United States, and Mexico)

The Middle East countries will need a certificate of origin, Certificate of Origin,

Others such as the Certificate of Quality.

Hygiene Certificate etc. depends on the import regulations,

Mainly it depends on the customs clearance needs of the customers!

Of course, Master Air Waybill MAWB, Master Airway Bill needs to ship together with the plane.

There are also HAWB, House Airway Bill can ship together with the plane when the goods are delivered.

The Master Air Waybill is the document that must be ship together with the goods.

Because the air waybill is a contract of carriage between the carrier and the shipper, it is also the receipt of the goods issued by the carrier or its agent.

Importers from South American and Africa countries usually have to provide original invoice documents with an air shipment.

Some countries in Europe need the original invoice to facilitate the truck transit of the air cargo shipment.

But it is not strict for Asia North America and Oceania countries.

If the document air shipment is lost during transportation,

Usually, need to re-delivery.

Or provide an electronic file to allow clients to print by their own.

Destination custom clearance is usually done by the customer themself or his agent

2. Convenient for airport cargo terminal staff to distribute goods.

Such as the air shipment document of sub-order, sub-bill, etc.

Because the shipments are consolidated from the start airport.

At the destination port, it must be separated based on the sub-order/sub-bill.

Separate goods from different batches, different bills, and different consignees,

Then notify the consignee separately to making customs clearance, separate delivery and so on.

3. Avoid delay in import custom clearance

Air transportation is fast, especially for direct flights,

If you ship the air transport documents by international express mail,

It is easy to meet the problem that goods are waiting for the air documents to clear customs.

because customs clearance documents (invoices, bills, CO, etc.) have not arrived yet.

4 Precautions

(1) Airfreight documents are mainly used for customs clearance at the port of destination. The customs clearance of the destination import has nothing to do with the customs declaration of domestic origin. It should keep in mind not to confuse the customs clearance documents required by the customers with our export declaration documents. Sometimes the invoice for the customs declaration is not the same as the air shipment documents, especially the total amount. At this time, the importer should pay more attention if the declared value is not the same as the original ones.

(2) For the air shipment documents, it is generally the shipper that send the customs declaration documents together with the air freight documents to the freight forwarder by courier, or when the driver picks up the goods, the driver brought to the freight forwarder by the way. At this point, Shipper must explain the customs declaration documents and customs clearance documents with the driver to avoid any trouble.

(3) Customs declarations are used for customs declaration, and air freight documents are accompanied by air waybills, manifests, etc., and the destination clients or customs clearance agents can obtain customs clearance documents. Since the documents and the goods arrive at the same time, the customs clearance will be no delay.

Import customs clearance process

- The airline carrier transmits the flight and its cargo information to the airport customs through the computer.

- The airline company sends the pickup/delivery notice to the consignee.

- The consignee prepares customs clearance information and imports customs declaration to the airport customs.

- The airport customs signing and issuing the release to the consignee.

- The consignee picks up the goods by the customs release slip.

(4) Documents with Airfreight such as packing list and commercial invoices, some destinations only need to be copied ones, and no originals are required. However, some countries, such as countries in South America, must have originals, copies or scanned copies will be not effective. Please be sure to confirm with a freight forwarder in advance the required documents of customs clearance.

(5) The destination port clearance document provided by the shipper can be carried by airline, but this is not within the carrier’s carrier range. If it is lost, the airline is not responsible. Therefore, if you have more important documents such as CO, you can choose to send them to by international courier.

Arranging shipping custom clearance documents is a critical aspect of export and import. To make things easier for your company, you can just tell us your shipping needs, we will provide the best shipping solutions for you. Let us make your import shipping easier for you. Simply fill out the form on Ask Free Quote to start your free shipping quote now.

Leave A Comment